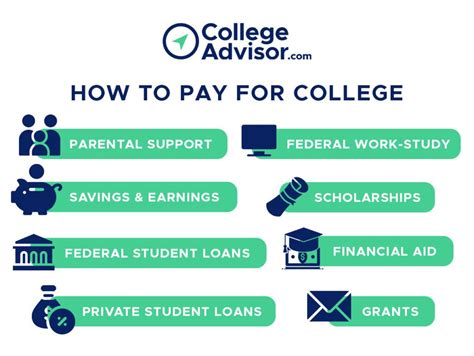

Navigating college costs can be a daunting task. Tuition, fees, and living expenses can add up quickly, leaving you wondering how to pay for college. Financial aid options like scholarships, grants, and loans can help bridge the gap, but they may not cover all your expenses. Exploring work-study programs allows you to earn while you learn, and tax benefits can provide additional savings. But with student loans becoming an increasingly common way to finance college, it’s crucial to understand interest rates and repayment options to minimize debt and balance college costs with your other financial goals.

Understanding College Costs: Tuition, Fees, and More

The cost of college can vary widely depending on the institution, program, and location. Here’s a breakdown of the key components that make up the total cost:

- Tuition: The primary charge for instruction, covering academic programs, classes, and faculty salaries.

- Fees: Additional charges for specific services, such as registration, health services, student activities, and technology.

- Room and Board: Housing and meals provided by the university or off-campus.

- Books and Supplies: Course materials, textbooks, and equipment required for classes.

- Transportation: Costs associated with commuting to and from campus, including car payments, insurance, and gas.

- Personal Expenses: Clothing, entertainment, and other miscellaneous costs.

It’s important to factor in all these costs when budgeting for college to avoid any unexpected expenses.

Exploring College Cost Calculators

Many colleges and universities provide online cost calculators that can help estimate the total cost of attendance based on factors such as residency, program, and living arrangements. Using these calculators can provide a starting point for financial planning.