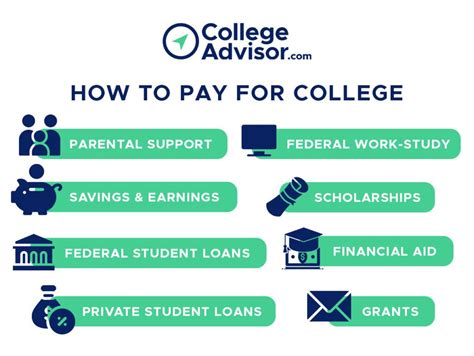

- Financial assistance to offset college costs

- Practical work experience in the chosen field

- Opportunities for networking and professional development

Eligibility for Work-Study

To be eligible for work-study, students must demonstrate financial need as determined by the FAFSA. Eligible students may be awarded a certain number of hours to work each week during the school year.

Maximizing Tax Benefits for Education Expenses

The government offers tax benefits to help reduce the cost of education. Here are some key tax breaks to consider:

- American Opportunity Tax Credit (AOTC): A tax credit of up to $2,500 per eligible student for qualified expenses in the first four years of post-secondary education.

- Lifetime Learning Credit (LLC): A tax credit of up to $2,000 per eligible student for qualified expenses beyond the first four years of post-secondary education.

- Student Loan Interest Deduction: A tax deduction of up to $2,500 for interest paid on qualified student loans.

To claim these tax benefits, eligible students must meet certain income and educational requirements. It’s advisable to consult with a tax professional for specific guidance.