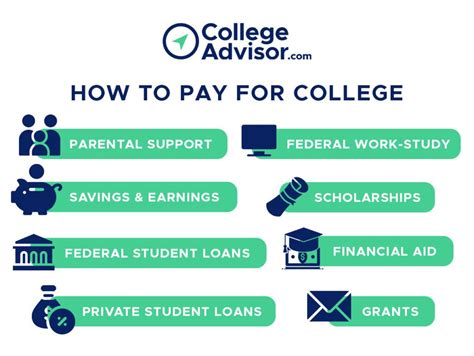

Exploring Alternative Funding Sources: Crowdfunding and Private Loans

In addition to traditional financial aid and scholarships, there are alternative funding sources that students can consider:

- Crowdfunding: Online platforms that allow individuals to raise funds from multiple donors to support projects, including educational expenses.

- Private Loans: Loans from banks or other lending institutions that are not backed by the federal government, typically with higher interest rates and less flexible repayment options.

Weighing the Pros and Cons of Alternative Funding

When considering alternative funding sources, it’s important to weigh the pros and cons carefully:

- Crowdfunding: Pros – potential for wide reach, community support; Cons – can be competitive, may not meet funding goals

- Private Loans: Pros – can supplement other financial aid, flexible repayment options; Cons – higher interest rates, less flexibility compared to federal loans

The Role of Student Loans: Understanding Interest Rates and Repayment

Student loans can be a valuable tool to cover college costs, but it’s essential to understand the terms before borrowing.