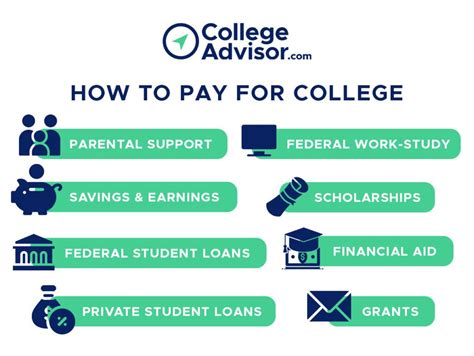

- Borrow Only What You Need: Carefully consider your college expenses and financial aid options before taking out loans.

- Explore Federal Loan Forgiveness Programs: Certain federal loan forgiveness programs may discharge your debt after a period of public service or income-driven repayment.

- Refinance Your Loans: Refinancing may secure a lower interest rate on your student loans, potentially saving you money in the long run.

Seeking Professional Guidance

If you’re struggling to manage student debt or need guidance on repayment options, consider seeking professional advice from a financial counselor or loan servicer.

Balancing College Costs with Other Financial Goals

It’s important to consider how college costs may impact other financial goals, such as saving for retirement or purchasing a home.

Prioritizing Financial Goals

Set financial priorities and determine which goals are most important to you. Consider the potential long-term returns and risks associated with different investments.